831 Benefactors have supported us

over the last five years

Now more than ever, private support from generous benefactors is accelerating progress and enabling top talent to push the boundaries of the possible. Every dollar invested today results in discoveries made and lives saved.

831 Benefactors have supported us

over the last five years

235 first-time benefactors

$20 million+ represents total giving

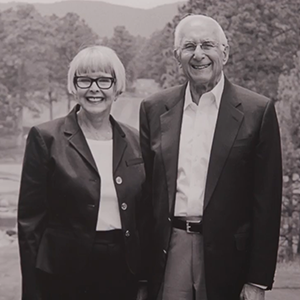

"The legacy is giving back. We've been so blessed with what we've received from the university that giving back is the legacy."

Edward and Karen Skaff

(Class of '59 and Class of '92)The University of Colorado Foundation website offers the ability to give gifts by credit card. Online contributions, like other charitable contributions may qualify you for tax deduction.

Please use this giving form and mail it along with your check to the address noted on the form.

When you create a recurring gift, you support CU Skaggs School of Pharmacy in a sustainable and convenient way. To begin, select the fund you want to support, enter your gift amount and be sure to select “This is a recurring gift” within the form.

Planned gifts are investments in the long-term stability of the CU Skaggs School of Pharmacy. They ensure a steady stream of philanthropic income for decades. Your planned gift will propel our educational programs, clinical care and research for years to come.

You can give more than just money to the CU School of Pharmacy. A gift of real estate is a generous way to make an impact at CU while avoiding costly property maintenance costs. Our team of experts is specifically trained to make giving real estate to CU a seamless process.

You can create a lasting legacy for loved ones by creating memorial and tribute funds. This is a thoughtful and generous way to honor a friend or family member while making a difference at the CU Skaggs School of Pharmacy and Pharmaceutical Sciences, allowing us to continue our life-changing work and recognize the legacy of your loved one.

More than 15,000 companies and subsidiaries will match tax-deductible charitable contributions made by their employees, retirees and employees' spouses—which can double (or triple) the value of your gift! Matching gifts are directed to the same designation as your original gift, unless your employer dictates otherwise.